|

Eligibility Requirements:

|

|

The Atlas Series is available to you if you are at least 14 days old and traveling outside of your Home Country.

If you are a U.S. citizen, your Home Country is always the United States, regardless of the location of your Principal Residence.

If you are not a US citizen, Home Country is the country where you principally reside and receive regular mail.

|

|

Group members must choose the same primary destination. U.S. citizens covered under Atlas Group cannot travel to

destinations within the U.S. or U.S. territories. Enter only individuals who will be traveling. It is not necessary

to enter family members who will not be traveling. The Atlas Series is not available to individuals who are physically

located in the states of New York, Maryland, or Washington or in the country of Canada or Australia at time of purchase.

|

|

Will your trip include the US or US territories as a destination

country?

|

|

If you are a non-US citizen and non-US resident and any part of your travel includes

the US, you must answer Yes to this question.

|

|

US Territories - Major US territories include Puerto Rico and the US Virgin

Islands. You may answer No to this question for travel that includes Guam, American

Samoa, and Northern Mariana Islands.

|

|

Layovers - If you are a US citizen or US resident with a layover in the US

prior to your departure from the US, your coverage will begin when you depart the

US. You should answer No to this question. If you are a non-US citizen or non-US

resident and your travel will include a layover in the US, you should answer Yes

to this question.

|

|

Incidental Trips Home - For each three (3) months during which a Member is

covered hereunder, Medical Expenses only are covered during incidental trips totaling

no more than 15 days duration per three-month period of coverage. Incidental visit

time must be used within the three-month period earned, and the Member must continue

his or her international trip in order to be eligible for this benefit. Return to

the Member’s Home Country must not be taken for the purpose of obtaining treatment

of an Illness or Injury that began while traveling. US citizens whose travel will

include an Incidental Trip to the US may answer No to this question.

|

|

Date Coverage Should Begin and End

|

|

Your coverage becomes effective on the latest of: the date we receive your Application

and correct premium, the moment you depart from your Home Country, or the date you

request on your Application.

|

|

Your coverage will end on the earliest of: the end of the period for which you have

paid a premium, the date requested on your Application, or the moment of your arrival

upon return to your Home Country (unless you have started a Benefit Period or are

eligible for Home Country Coverage).

|

|

Deductible

|

|

The dollar amount of Eligible Expenses that the Member must pay per Certificate

Period before the plan begins to pay covered expenses.

|

|

Coverage Amount

|

|

The maximum amount of all benefits, except for Emergency Medical Evacuation, Accidental

Death and Dismemberment and Common Carrier Accidental Death.

|

|

Optional Crisis Response Benefit Rider

|

|

This rider allows you to purchase an additional $90,000 in Crisis Response coverage, with the added benefit of $10,000 for Natural Disaster Evacuation. As Atlas Travel provides $10,000 in Crisis Response coverage in the base plan, purchasing this rider would increase the total Crisis Response benefit to $100,000.

|

| Base CR Coverage |

Additional CR Coverage Available |

Total CR Coverage Amount |

| $10,000 |

$90,000 ($10,000 sublimit for Natural Disaster Evacuation) |

$100,000 |

|

|

Optional Personal Liability Benefit Rider

|

|

This rider allows you to purchase an additional $75,000 in Personal Liability coverage. As Atlas Travel provides $25,000 in Personal Liability coverage in the base plan, purchasing this rider would increase the total Personal Liability benefit to $100,000.

|

| Base PL Coverage |

Additional PL Coverage Available |

Total PL Coverage Amount |

| $25,000 |

$75,000 |

$100,000 |

|

|

Optional Accidental Death & Dismemberment Benefit Rider

|

|

This rider, available to Members age 18 to 69, allows purchase of additional Accidental Death and Dismemberment (AD&D) coverage. Coverage may be increased to equal the medical maximum coverage amount. The AD&D benefit is not subject to the overall policy maximum.

|

|

Accidental Death and Dismemberment coverage provides benefits in the event of your death or loss of limb due to an accident. It does not cover certain activities and conditions, as listed in the policy.

|

|

As Atlas Travel provides $25,000 in AD&D coverage to Members age 18 to 69 in the base plan, this rider would increase the total AD&D benefit to $50,000.

|

| Base AD&D Coverage |

Additional AD&D Coverage Available |

Total AD&D Coverage Amount |

| $25,000 |

$25,000 |

$50,000 |

|

|

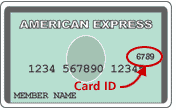

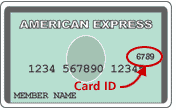

Card Security Code

|

The Card Security Code is an added security feature to help protect you against

online fraud.

The Card Security Code is the group of numbers immediately following your credit

card number on the back of the card. These numbers are used by your credit card

company to help prevent fraud. Because the Card Security Code is not printed on

your receipts, it helps ensure that someone is not using your credit card information

fraudulently.

Visa, MasterCard, and Discover

For Visa and MasterCard there are 3 digits on the back of the card in the

area shown by the graphic above.

|

|

American Express

For American Express there are 4 digits on the front of the card in the area

shown by the graphic above.

|

|

|